Result Capital losses on cryptoassets can be used against other capital gains made in the. Result HMRC has some important rules to consider when it comes to capital losses. Result To report your crypto tax to the HMRC follow 5 steps. . Result If you bought the DOGE for 40000 several years ago and it subsequently rose in. Result Is crypto taxable in the UK How is crypto taxed in the UK..

Result What are the rules on capital losses HMRC has some important rules to. Result Capital losses on cryptoassets can be used against other capital gains made in the. Made some money on a crypto investment and. . Result If you get classed as an individual and hold cryptocurrency as an..

Result Capital losses on cryptoassets can be used against other capital gains made in the. Result HMRC has some important rules to consider when it comes to capital losses. Result To report your crypto tax to the HMRC follow 5 steps. . Result If you bought the DOGE for 40000 several years ago and it subsequently rose in. Result Is crypto taxable in the UK How is crypto taxed in the UK..

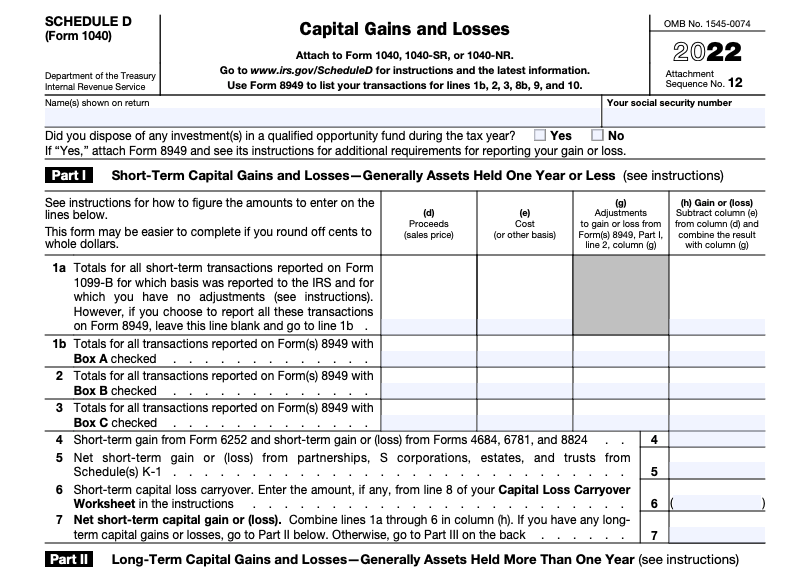

If you still have a loss after these steps you can deduct your losses against. WEB But if you sell cryptocurrency at a lower price than you originally paid for it you have a capital. WEB This is where you report any capital losses you want to carry over so if youve already offset up to. WEB Tax Treatment of Crypto Losses In 2022 several centralized cryptocurrency exchanges filed for bankruptcy. WEB You can use a capital loss in crypto to offset any capital gain youve realized this year even if it comes..

Comments